As a part of EEA Forum taking place November 26th the top investment and finance experts shared their opinion and ideas on investment and business attractiveness in Ukraine. The question turns out to be pretty controversial as the foreign investors’ interest definitely exists, but the business climate in the country leave much to be desired.

Main reasons keeping the foreign investors from entering the market

According to Erik Nayman, Managing Partner at Capital Times, the problem has several ingredients. One of them is a low income level. For last two years GDP of Ukraine has crashed from $4000 to $2000. The average salery accounts for $200 per month, and pension - $50 per month. So even low purchase power is an existing obstacle for successful commercial real estate development.

Natalia Kochergian, DLA Piper Ukraine points out that today most of transactions with real estate in Ukraine are sales of real estate to the local investors by the foreign ones.

Moreover, according to Heinz Strubenhoff, IFC, Ukraine legged behind many countries of EEA region in Doing Business rating issued by the World Bank on an annual basis. «Ukraine took the 83rd position in the rating among others. Kazakhstan, for instance, is 41st, Belarus – 44th and Georgia – 24th».

Among the main factors, which have a detrimental effect on the country are corruption, low level of access to finance, inflation and political instability, high taxes, bureaucracy and inefficient state management.

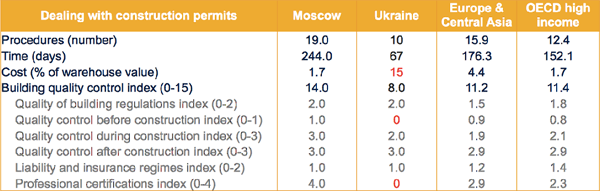

One of the key values to determine the position of the country in the Doing Business rating is dealing with construction permits.

Among the negative aspects are the cost of all construction permits which account for 15% of the total cost of all construction works. As a comparison, it is about 1,7-4,5% in the neighboring countries. Moreover, there are neither quality control before construction nor professional certifications in the country.

When should we expect stable economic growth

Experts say that still there is an interest of the foreign investors. According to Nick Cotton, Managing Director at DTZ Ukraine, lately Amercian investros seek opportunities in the country while earlier extraneous capital came mostly from Europe.

It's good time for venture companies as banks today are not ready to finance transactions with real estate. Activation of mortgage lending is possible only when we see economic growth.

Ukraine missed its chance to implement economic reforms in 2015. Optimistic forecast says we can expect economic growth as early as autumn 2016 or beginning of 2017. At the worst, Ukraine will face new restructuring in 2018.

Analytics believe that success directly depends on economic reforms. There are a lot of disputes about fighting corruption in Ukraine, however, new tax code and new state budget, fiscal policy of the Ministry of Finance of Ukraine don’t hold out a hope of easing the tax burden. That means it is a highly likelihood there will be no foreign investments unless situation changes.

The only attractive segment for investments as of today is residential real estate. However, this refers mostly to private local investors who choose to buy property to a great extent because of banking system failure.

Banking system is collapsing, it has lack of trust, many people took their deposits from banks and USD exchange rate is very high and makes no economic sense for people. So residential segment is the only way to save money, which is bound to develop in the future.

Author: Natalia Reva, URE Club