Ukrainian Real Estate Club (URE Club) together with the international consulting company PricewaterhouseCoopers (PwC) initiated and prepared Research on Emerging Trends in Real Estate and the Industry's Challenges in 2017. The Research is based on a direct anonymous survey of the experts in the real estate market in Ukraine and analysis of the final statistics. Both ready-made options and the ability to specify the own option were suggested for the answers. The Research reflects key issues of residential and commercial real estate, its investment potential and business environment.

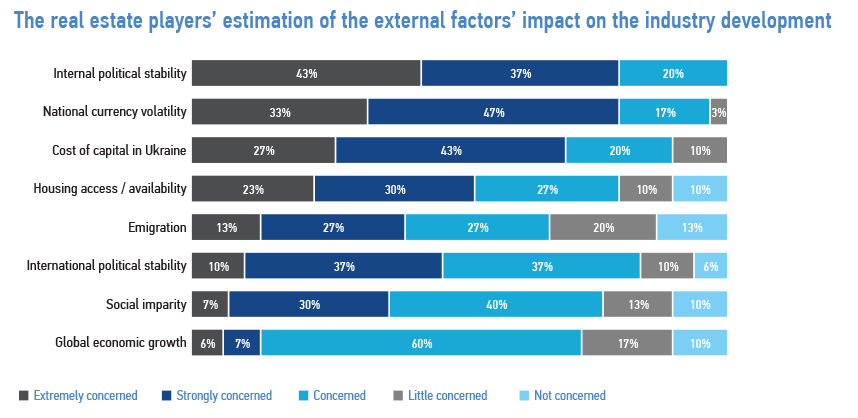

Even though, Ukrainian real estate market demonstrates a recovery comparing to the previous year, the real estate players are still extremely concerned about macroeconomic and social factors, which have significant impact on the business efficiency.

- Level of political stability;

- Global economic growth;

- Internal political stability in Ukraine;

- Volatility of the national currency;

- Housing access/availability.

The combination of these factors significantly complicate the long-term planning and, as a result, restrain investments.

Among the reasons for the concern also are military actions in the Eastern Ukraine, high level of corruption and lack of sustainable models of cooperation between real estate businesses and communities. All these factors increase the «non-market risks» of running real estate business in the country

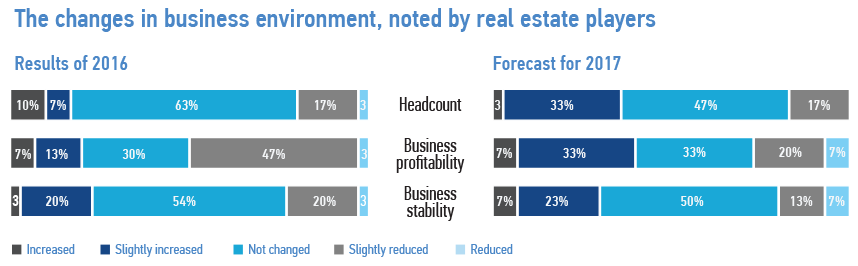

According to results of 2016, almost half of the respondents (47%) noted the decline of the business profitability. Only third part of the intervieees forecast its growth in 2017. Interestingly that 13% recorded little growth during the year.

60% of the respondents believe the Ukrainian real estate market is left by the foreign players rather than local companies. At the same time half of the respondents the premium assets are still overvalued.

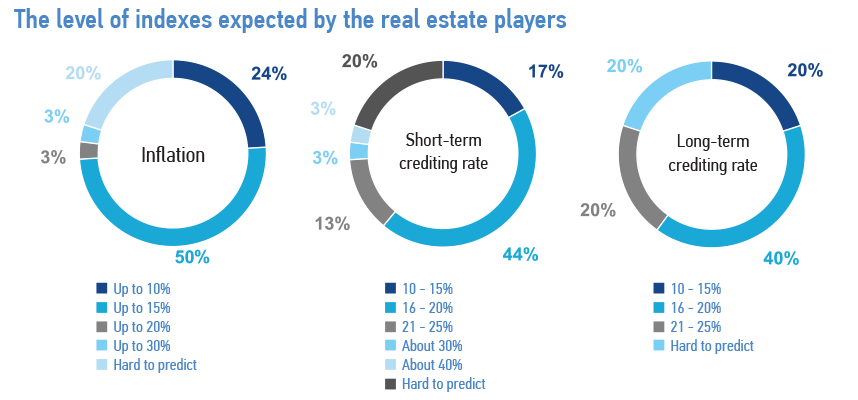

The level of inflation by the end of 2017 is expected to be at the level of 12-15%. The long-term crediting rates is predicted to be within 16-20%.

The increase volume of construction is expected by the real estate players in Kyiv, Lviv and Odesa. 70% of the interviewees believe Lviv to be the leader among other cities. The decline of construction volumes is likely to be in Kharkiv and Dnipro.

Among the most promising areas of real estate business are construction of residnetial real estate of comfort class (47%), affordable housing (43%), shopping malls in the city (37%) and street retail (33%). 23% of the interviewees also think rental houses as promising niche for development, other 17% consider business parks among such. Development of housing for students has potential in Kyiv.

The potential of the hotel real estate is estimated as averga. Even though, 2 and 3-star hotels have good chances for growth in case if they are of high quality and holistic business model. Third part of the respondents noted there is a potential for hostels and service apartments development.

Most of the respondents (87%) share the opinion that long-term mortgage can make the market to grow and attract direct foreign investments. Other 46% believes that market needs simplification of control procedures and only 10% think that mong the key drivers of growth is the abolishing of moratorium moratorium on sale of agricultural land.